What is Comprehensive and Collision Insurance?

- Get link

- X

- Other Apps

When you hear someone use the term “comp and collision,” they are referring to two separate insurance coverages available for personal auto insurance policies: Comprehensive coverage (also referred to as Other Than Collision coverage) and Collision coverage.

What is Comprehensive insurance?

Comprehensive insurance helps pay for damages to your vehicle caused by factors other than an accidental collision, such as fire, vandalism, weather (hail, flooding, wind, lightning, etc.), theft, impact with an animal, etc. (Exclusions may apply.)

Here are some examples of when Comprehensive insurance may apply:

- Your vehicle is damaged in a hail storm (other damage sources may include flooding, wind and lightning)

- Someone vandalizes your vehicle by slashing your tires and breaking all the windows

- You hit an animal with your car on your way to work

- A storm causes a tree to fall on your vehicle

- Someone steals your vehicle

- Your neighbor’s brush fire gets out of control and sets your vehicle on fire

Comprehensive insurance coverage does not cover your vehicle from all types of damage. This is a common misconception.

For example, Comprehensive insurance does not cover damages resulting from:

- Getting hit by another vehicle

- Accidentally hitting another vehicle or object

- Vehicle upset, such as accidentally rolling your vehicle

These damages are typically covered by Collision insurance. (Exclusions may apply.)

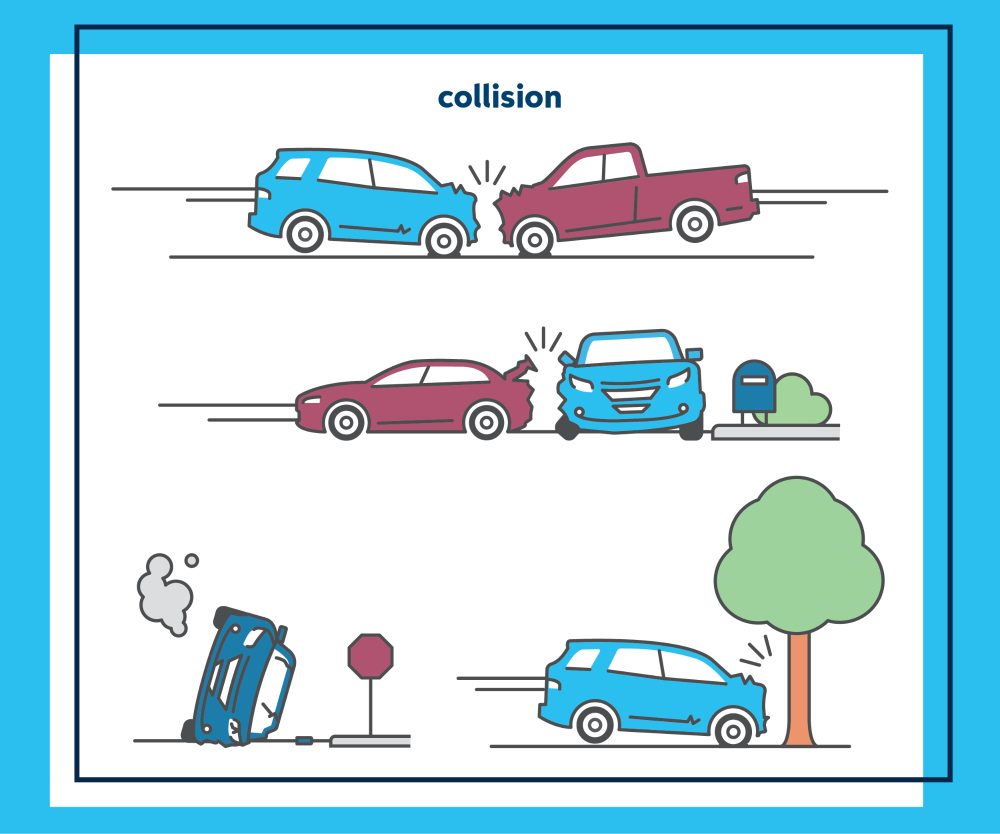

What is Collision insurance coverage?

Collision insurance helps cover the cost of loss or damage to your vehicle when it is involved in an accidental collision with another vehicle or object. (Exclusions may apply.)

Collision insurance coverage is exactly what it sounds like. It covers you when your vehicle collides with an object, or another car. It generally provides coverage for situations where you are the one being hit or where you accidentally hit another vehicle.

Even situations where your car is parked and hit by another vehicle or by an object on the ground is typically covered by Collision insurance.

- Another vehicle hitting your vehicle

- Your vehicle accidentally hitting another vehicle

- Accidentally backing your vehicle into a pole or other object

- Damage from another vehicle backing into your vehicle, even if you are parked at the time

- Bottoming out your vehicle

- Accidentally rolling your vehicle over an object, or rolling your vehicle

What is the biggest difference between Comprehensive and Collision insurance?

The main difference between Collision insurance and Comprehensive insurance are the situations that each covers.

Comprehensive insurance covers your vehicle for situations outside of an accidental collision such as, damage from weather (hail, flood, wind, lightning, etc.), vandalism, theft, fire, damage caused by an animal and in the rare event that a light pole hits your vehicle.

Collision insurance covers a loss if your vehicle hits an object such as a light pole or another vehicle, or if another vehicle hits your vehicle.

- Get link

- X

- Other Apps

Comments

Post a Comment